Squeezing More Revenue From Your Marketing Dollars

March 10, 2015 by Julia·

Leave a Comment

This post from Paul Gorman originally appeared in March 2015 on Renaissance Executive Forums.

Marketing pioneer, John Wanamaker, once said “Half the marketing money I spend on advertising is wasted; the trouble is I just don’t know which half.”

I’m not going to tell you how to completely and totally fix that problem, but there is a way to significantly increase your revenue and, at the same time, reduce how much you spend on marketing and direct mail. We can do that through the power of the computer, big data and predictive analysis.

What Is Predictive Analysis?

We all know what big data is and you probably have an enormous amount of it stored on your computers or in an archive. Predictive analysis mines that data, turning it into information that can be acted on. By mining the historical data that you keep collecting, we can pull out information from the data and find statistical relationships and meaning that best describe the past behavior of your customers. We then apply that knowledge to predict future customer behavior and improve the bottom line of your business.

Probably the best known application of predictive analysis is your own FICO score, a measure of consumer credit risk. Your FICO score rates you as a consumer. Almost everybody has a FICO score even if they are not aware that they do. It gives your lender a way to predict the probability that you will default on your loan and the likelihood that he will get his money back. The higher your score, the less likely you are to default on your debt, and, therefore, you represent less of a risk to the lender. As a result, with a high FICO score you can typically qualify for better terms when you buy a house or car, or apply for any other kind of loan. With a low FICO score you may be able to obtain a loan, but it may be financially painful for you because you’ll have to pay a premium to make up for the lender’s risk.

Where Is Predictive Analysis Applied?

Predictive analysis can be applied to a myriad of fields besides credit, marketing and direct mail. One example of where predictive analysis is paying big dividends is law enforcement. For instance, the San Diego County Sheriff has a small staff of analysts applying predictive analysis in order to help reduce jail overcrowding as a result of recidivism. This not only reduces jail overcrowding, but reduces taxpayer expenses as well.

A few other examples include: stock market trading; safety and failure analysis; employee retention; fraud detection; network intrusion detection; and political campaigning with voter persuasion modeling.

How Can Predictive Analysis Help Your Business?

Direct mail marketing is one important area where predictive analysis excels and can pay big dividends to your business. In this case, after mining the data and applying our predictive analysis techniques, we can assign probabilities or scores to each individual in your database, and can rank them according to the likelihood of their behavior or actions. Now we can easily tell who your best customers are, ranked from top to bottom. This is an objective measure, not subjective, and allows us to separate the “wheat from the chaff.” Subjectively though, you still have the option of including Uncle Bill in the list if you want to, even though he is way down in the bottom half, and just loves the free buffet.

If we already have a direct mail list, we can then match that list against what we now know. This produces a more optimal mailing list, one typically far superior to the one created in almost any other way. For instance, if we have a million people in our database, but are mailing to only half of them, we can now be very sure that we are mailing to only the top half. The cream has risen to the top. (I love mixing metaphors.)

Once we have that information, we can then even further refine our superior mailing list and begin to predict what each customer is most likely to respond to. That way, instead of just shot-gunning one or two offers to all half million of our best customers, we can actually segment them into categories, and tailor our marketing much more precisely to appeal to each segment. The best number of segments and types of offers can also be found through predictive analysis.

Altogether, the results of this approach are to (a.) market to those customers whom we know are our best customers; (b.) present tailored offers to those customers in a way that they are most likely to respond; and (c.) actually take control of our direct marketing campaigns and dollars by choosing not only who to market to, but also who not to market to. As hard as not mailing to someone may be – such as Uncle Bill – we can now objectively know that the customers way down our mailing list are probably just not worth the stamp. This, of course, reduces marketing costs.

Example 1 – Mailing Better Customers

Here is an example using our database of 1 million people. Let’s assume that that you mail to half of them, and it costs $2 to mail to each one. You have observed that your response rate is 1%, and the average revenue produced by each customer who responds is $200.

Profit = Revenue – Cost

Profit = $1,000,000 – $1,000,000 = $0

So, why are we doing direct mail again?

Predictive analysis allows us to improve on these results. Now suppose that your predictive analyst crunches some numbers, and is able to rank your customer database from top to bottom. He finds that he can replace half of your original mailing list with better customers. As a result, your response rate increases to 1.5%. Also, because you are mailing to an optimal set of customers, you can expect that the average revenue produced jumps to $225. Now let’s see what happens.

Profit = Revenue – Cost

Profit = $1,687,500 – $1,000,000 = $687,500

Example 2 – Mail To Only The Best

The second way to improve bottom line results is to reduce the size of our mailing list, and save the money. This, of course, cuts costs. In this example, if we only mail to the top 250,000 customers, then we will have saved $500,000 in mailing costs. But that comes at a price. Since the customers we are no longer mailing to are at the bottom of the list, their response rate and average revenue is less than for the entire group of 500,000. Therefore, let’s assume that the response rate for those included in the mailing increases a little, to say 1.6% and our average revenue increases a little to $230. Let’s see what happens.

Profit = Revenue – Cost

Profit = $920,000 – $500,000 = $420,000

In this example, we probably cut our mailing list size too much, but you get the point. We saved $500,000 in costs, but only reduced our resulting revenue by $267,500. Nevertheless, we may have gone too far in our cost-cutting.

But what if you only have a $300,000 direct mail budget? Then that additional $267,500 starts to look pretty good. How can you start to make up the difference on the revenue side?

Example 3 – Tailor Offers to Value

One way to raise revenue and still keep our direct mail size and costs down is to be smarter about what we offer our customers. As mentioned above, we can better tailor our offers to better fit specific segments of our mailing list. This will improve our response rate and the average revenue per customer will increase as well. In our simple example above, improving the response rate by only 0.25% increases our revenue by about $300,000 while our mailing costs remain the same.

Here is how this could work. As a strategy, let’s still use the $500,000 direct mail budget, but segment our 250,000 mail list in to 2 groups of 125,000 each. In the top group we can expect a response rate of 1.75% and in the lower half a response rate of 1.5%. In the top group we can expect an average revenue of $250, and in the lower group average revenue of $230. Now what happens?

Profit = Revenue – Cost

Profit = ($546,875 + 431,250) – $500,000 = $478,125

So compared to our results in Example 2, we have increased our expected profit by $58,125 by minimally segmenting our database and sending two different offers, each more aligned with the needs and interests of our customers. We can probably improve even more on our results by further segmentation and tailoring.

The Bottom Line

Now direct mail starts to make sense again, and we have a way to squeeze more revenue from our marketing dollars.

Let’s recap and look at where we’ve actually come from when we started this discussion. We started with a huge mailing list, an OK response rate, an OK average revenue per customer, but zero profit from our efforts. By applying Predictive Analysis step by step through a rigorous process, we’ve actually improved both our response rate and our average per customer revenue while we reduced the size of our mailing list and cut costs.

Increased revenue. Lower costs. What’s not to like?

The Data Fact Gap

August 6, 2014 by Julia·

Leave a Comment

As professionals, we all know that technology has changed the way we do business. Whether you find the increased dependence on new technology as good or bad often depends on how effectively the tools are used. Over the years, this problem has been illustrated in many ways by Stics and a variety of other experts.

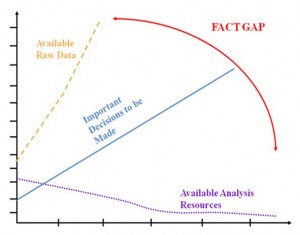

This particular Fact Gap illustration was first attributed to the Gartner Group. It will help us describe how data technologies are, on the one hand, progressing and on the other, creating new data analysis problems.

The “Data Fact Gap” was created by the explosion of available digital information accumulated in recent years. With technology system advances, increased data storage capacity and Internet usage it is now easy to collect mountains of data. While the volume of retained data has grown exponentially and spread across all industries, so have the data management challenges it created and the even greater marketing opportunities that mostly lie dormant.

This abundance of data creates new problems that force database marketers to devote a lot of time and resources to filtering information into data segments so decision makers can frame a concept, problem or question. While this approach is intuitive to the human brain, it does limit our ability to make a fully informed decision from all available data.

Why You Need Good Data

Intuitively we often think we already know what our customers want. However, that is not always the case. When we make business decisions by filtering our data down to a few variables we miss the more accurate and complete view of the data. Without hard data, there’s no way to be sure truly objective decisions are being made. Worse, because we think we’re making objective decisions, we often don’t seek an outside perspective.

What we really need is an objective analysis, wielding as many customer factors and data points as possible. This approach helps us see the potential hidden below the common database marketing analysis.

Statistical Predictive Analytics Solves the Problem

One way to harness the data explosion and make better marketing and business decisions is to use predictive analytics. Predictive analytics uses the science of statistics and is capable of considering unlimited facets of a situation. Predictive analytics for marketing can increase a marketing campaign’s return on investment by 10 times compared to a typical SQL analysis that might only evaluate (about) five variables. It takes the data that you already have and gives you information you can use in your marketing campaigns, such as:

- Identifying customers you are currently marketing to who are unprofitable or about to reach the end of their customer lifetime value

- Identify high value customers hiding in your database or prospects you are not marketing to

- Suggest more profitable marketing programs

- Identify the lifetime value of various members in your customer base

Statistical modeling with predictive analytics is proven to help make more informed decisions and increase profit margins.

Stics lives on the front lines of customer data knowledge generation. We have a deep understanding of the problems and opportunities created by the data explosion. For that reason, we discourage installing expensive applications that might not provide quick answers to important questions that drive revenue and profitability. We know that with seasoned expertise, a leading statistical technology platform and focused services like ours, it is possible to bridge the data gap and quickly and easily improve the performance of your marketing campaigns.

Stics offers innovative solutions that provide deeper insight into your customer and loyalty database for greater marketing return on investment. We welcome inquiries and are happy to answer questions. We’re waiting to talk to you. Let us know what’s on your mind.

Casino Gaming Database Marketing Strategies

August 19, 2011 by Stics·

Leave a Comment

No Change in Database Marketing Strategies

Another fact we learned from our casino marketing survey was that most casino properties stuck with their existing db marketing strategies, even with the downturn. Basically, we found that:

- Despite the status of the business, almost 40% (39.1%) of properties are not changing their db marketing strategies.

- About a fourth of the industry is simply adjusting their marketing budget. More properties are increasing spending (17.4%) than decreasing (8.7%) marketing spending as a response to the situation.

- Another quarter (26.1%) are mailing different individuals with the same budget.

- Another 8% of properties are dealing with industry situation by buying new machines.

Strategies for db Marketing

The survey revealed that the gaming industry moved toward more tiering.

- 27% used Three-tiered database

- 42% mail 4- 12 tiers

- 12% mail at least 25 tiers

- 19% did not use or not known

Opportunity to improve mailing sophistication

Stics believes there is a lot of opportunity to database market more effectively. Based on the survey results, campaign effectiveness can be improved by:

- Trying new things (because 40% were mailing same)

- More complexity (because 69% were mailing fewer than 12 tiers)

- More Sophistication (only 23% using predictive analytics)

At a high level we know that loyal customers do come back, they just don’t spend as much. The problem is knowing which customer are likely to have more money to spend and how to bring back less frequent customers. Stics can help with that. Stics can unlock the power of your current database to maximize profitability and marketing effectiveness. For more information, call us today. We are here to help.

Casino Gaming Business Performance

June 10, 2011 by Stics·

Leave a Comment

More Up’s than Downs for Casino Gaming

We wanted to know how much the overall business performance in the casino gaming industry has changed in the previous year and our survey reveals that there actually has been more “up’s” than “down’s” as compared to the previous year.

More companies have improved in their performance than those who experienced decline; even so, most businesses yielded flat in their performance. This is vis-à-vis last year; so bottom hit for some.

- Things are better in places than expected (30.8% of businesses are up)

- More are up than down (30.8 up and 23.1 down)

- No improvement for bulk (61.6%) though (38.5% flat plus 23.1% down)

Stics offers predictive analytics to help you derive insights from your current data, make better informed decisions, and ultimately, improve your business performance. Call us if you would like to learn more. We are here to help.

MGM M Life Utilizes Innovative Customer Loyalty Program

January 7, 2011 by Stics·

Leave a Comment

MGM Generates Complete Customer Profile Across the Brand

MGM Generates Complete Customer Profile Across the Brand

In today’s economy, brands are finding new ways to be smart about attracting customers. Las Vegas casinos have always offered marketing promotions and comps such as free drinks, hotel rooms or tokens to keep customers coming back.

None, however, have gone as far as the new customer reward program from MGM Casinos M Life. This new customer loyalty program for MGM has found an innovative way to reward their customers and build brand loyalty.

Rather than focusing solely on customer’s gambling patterns, MGM tracks members of their reward program across all resorts and all facets of their hotels, including clubs, dining, spas, shopping and gambling. MGM then uses this information to offer its customers perks targeted to their personal interests. For more information on the program visit the M Life site or this recent Las Vegas Sun article about M Life.

Stics is pleased to have a number of MGM properties as Stics Predictive Analytics clients. MGM has a very strong marketing organization and they are always looking to improve their marketing strategies and tactics. As marketing optimization experts, Stics understand the complexities in executing multi faceted marketing program and expect the M Life approach to further enhance MGM Casinos revenue retention while building stronger brand loyalty with high value guests.

Casino Marketing Trends

September 3, 2010 by Stics·

Leave a Comment

Casino Marketing Survey

Earlier this year, Stics conducted a preliminary research project to gauge the state of the U.S. gaming industry, from a marketing perspective. We contacted both senior level business executives as well as high to mid-level marketing department professionals to learn more about their challenges and perceptions.

Listed below is a high level summary of some of the more interesting observations.

Top 5 Casino Marketing Observations

- Respondents felt their casino marketing efforts were performing well – despite the down economy.

- Direct mail volume of was up by 10 – 20%.

- Marketers put more value on the website and online programs while business leaders didn’t see value in the websites as compared to direct mail and analysis.

- Business leaders are “likely” to “very likely” to invest in new marketing technologies but marketing teams were “very unlikely” to “unlikely” to invest.

- Marketers were concerned about expenses.

While it is obvious that the economy has taken its toll on casino marketers and the gaming industry as a whole, Stics believes that today’s casino marketers are being asked to do more with less. As a result, they are executing on a large number of campaigns to a wider audience. This presents them with the new challenge of how to profitably reach this wider audience.

Stics is currently conducting a more comprehensive study as a follow up to our preliminary findings. We will keep you posted on other interesting facts when they become available.

Stics helps casino marketers reach a wider, more profitable audience through the efficient and effective use of predictive modeling. If you have any questions about predictive analytics for casino marketing, please give us a call. We look forward to speaking with you.